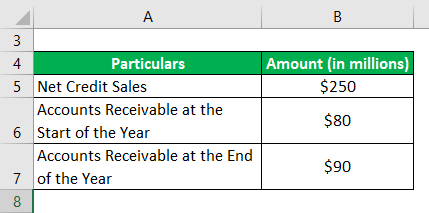

Cash sales result in an upfront payment, so these don’t create receivables. Here are three steps for calculating your accounts receivable turnover ratio: Step 1: Determine your net credit salesįirst, it’s important to note that when measuring receivables turnover, we’re only interested in looking at sales made on credit.

#Accounts receivable turnover formula example how to#

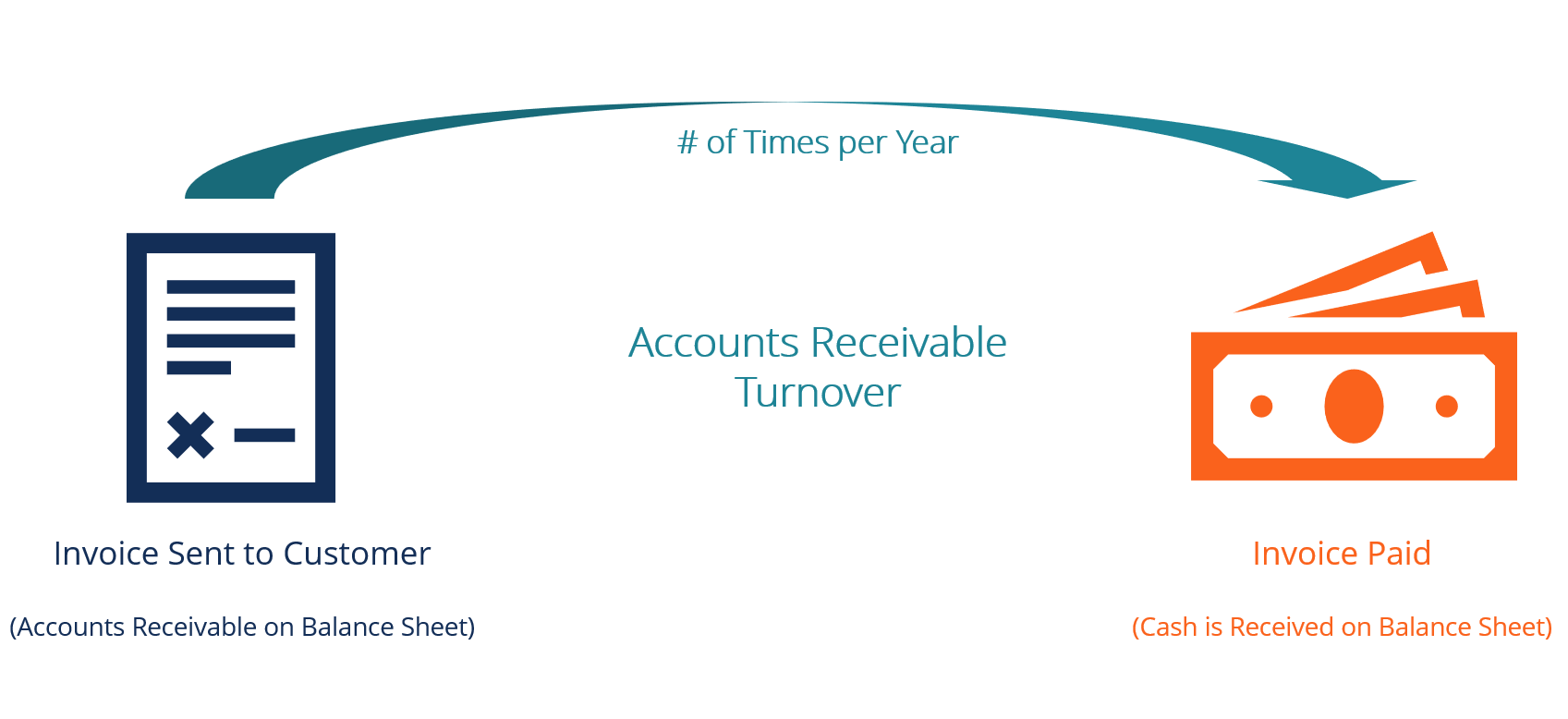

How to calculate accounts receivable turnover ratio Businesses hoping to secure funding or receive credit will want to ensure their receivables turnover is in a healthy place.Īccounts receivable turnover ratio also gives companies quick insight into how well their collections team is following up on overdue payments, how effective their credit policies are, and their customer base’s creditworthiness. Some corporate lenders will also look at a businesses’ accounts receivable turnover ratio to assess their financial health. This allows companies to forecast how much cash they’ll have on hand so they can better plan their spending. Finance teams can use AR turnover ratio when making balance sheet forecasts, as it provides a general expectation of when receivables will be paid. Tracking accounts receivable turnover ratio shows you how quickly the company is converting its receivables into cash on an average basis. It refers to the number of times during a given period (e.g., a month, quarter, or year) the company collected its average accounts receivable.

What is accounts receivable turnover ratio and why is it important?Īccounts receivable turnover ratio, also known as receivables turnover ratio or debtor’s turnover ratio, is a measure of efficiency.

0 kommentar(er)

0 kommentar(er)